Who doesn't? Everyone who works with payroll know that it can be a comprehensive job, where you have to have an eye for both details and the big picture , at the same time! Fortunately, the world is moving forward, and SAP has developed the Payroll Control Center (PCC) solution, also known as the control center. Our skilled colleague, May Lise Roseth Larsen, has extensive experience with this solution, both when it comes to implementation and use. Fortunately for us, May Lise has taken the time to write the article below, where she discusses the control center and how it can improve and simplify the daily work of everyone who works with payroll .

Enjoy :)

May Lise Roseth Larsen

Manager Solutions

The payroll process from A to Z

As a SAP payroll consultant, and since I previously has been working with SAP payroll in a payroll department, I am well acquainted with the payroll processing process and the various tasks that must be carried out during a month. You acquire data, record data and run payroll . The salary must be checked, possibly corrected, you complete the process, transfer to the bank, and post and report to the authorities. In addition, there may be follow-up work such as internal reporting, reporting to a third party and accounting tasks.

The tasks are largely repetitive since you do more or less the same thing every month. An important thing I have learned when it comes to payroll is that it is a good idea to make a good plan for the payroll run , or a detailed list of tasks. You must refine this, so that you always have good control on what has been completed for the month in question, and which tasks remain. This plan will be the leading document, and should be defined for your company.

But, even if you have good routines, it will, normally speaking, always get busy right before the payroll run , every single month! There can be sevarel reasons for this, but my experience suggests that it is because either:

- You spend a lot of time checking whether payroll is correct

- You have not distributed the tasks correctly - this leads to certain tasks being done twice

- Tasks are assigned to employees with a lack of competence to solve them

The control job is of course absolutely necessary to ensure that the payroll is correct, and all of us that work with payroll , agree that payroll must be correct! Imagine if there was a system that could do parts of these controls for you; this wolud let you save both time and resources . The good news is that such a system already exists! By implementing and putting into use SAP Payroll Control Centre, the system will do a large part of the control job for you !

A new way to control payroll

Payroll Control Center is a completely new way of planning and executing the payroll processes, as well as a new way of following up and checking that the results are actually correct. PCC makes it possible to automate the various steps in the payroll process. That is, you take the individual points in the timetable and enter them into the system. Some tasks can be performed by the system itself, some tasks are done manually and some tasks are performed in a combination of the two.

Even if a task has to be done manually, for example collecting tax cards, it is part of the process and it is important to include it in the list of tasks. Once you have completed a task, the system continues on to the next task or process. When you have the processes in the system, you get a tool that ensures control and documentation of the entire process. The tasks are structured and you get a full overview of how far you have come in the process . You also ensure the distribution of work, avoid lopsided workloads, while you document the entire job.

Less dependent on individuals

That Payroll Control Center is good for those who work with payroll , I hope I have made it clear, but the solution also has many advantages for the company . One of these is that your company will be less dependent on individuals in the payroll department. When the tasks are documented and entered into the solution, it is easier to transfer these to other colleagues. This is both important and relevant in connection with holiday processing and absence management.

Different roles - different tasks

In the standard solution for the control centre, different roles are defined. These can be linked to the different roles you already have in SAP . A payroll administrator can distribute tasks to the various payroll employees, and in addition control what the individual should be able to access to both see and perform. During a payroll process, new tasks will appear, and the solution can easily be set up so that the task is automatically assigned to the person who, in the system, is defined to solve precisely such cases.

The payroll administrator can also check the progress by seeing the status of the individual case, and at the same time monitor comments made on the various cases. In this way, you can produce higher quality both faster and more efficiently . Smart, right?

Different phases – different purposes

A really good functionality that PCC brings is the possibility to divide the salary process into different phases . You simply put the relevant tasks in the various phases. This gives you a good overview of how far you have come in the process, and what remains.

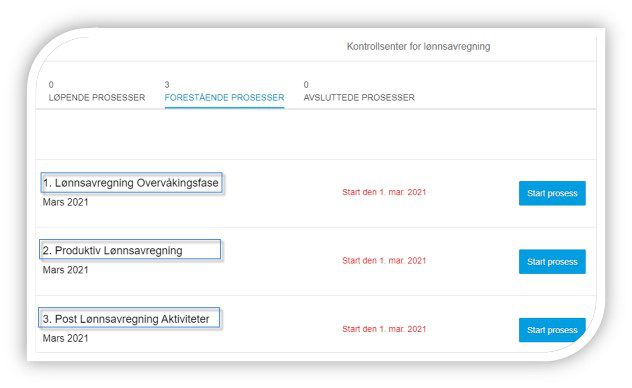

The picture shows an example of how a control center for payroll settlement can be set up. Here I have defined 3 different main processes;

- Monitoring phase

- Productive payroll settlement

- Finishing work

Within the various processes, I have set up different types of tasks.

The important monitoring phase

In the monitoring phase, it is normal to set up checks for data consistency , and what is often called master data. That is, data for an employee that can be checked before an actual payroll settlement has been carried out. Examples of such data can be:

- Social security number

- Bank account

- Address

- Tax card etc

More advanced controls can also be set up. Examples of such checks could be if an employee has had a salary increase registered that is too high in accordance with defined limits , that changes have been registered to an inactive employee , that a cost center used is locked , or that there is no consistency between registered data.

To achieve this, you initiate the controls and start monitoring. If any of the checks lead to a finding , a task will be sent to the payroll employee who is responsible for the employee to whom the finding applies. The payroll employee will then open the task, make the necessary checks and, depending on whether the missing information is available or not, either register and end the task, or enter a comment for later follow-up.

Which payroll employee is responsible for which employees is defined when you set up the PCC, and will be based on the setup of structure and roles . If you work in a large company, it may be natural that each payoll employee is responsible for their subsidiaries. In other cases, it may be natural for responsibility to be based on different types of employees, for example clerks and operators.

The set-up of roles will be adapted to the individual company , so you know that it is right for you. A big advantage of the monitoring phase is that you catch deviations and missing information at a much earlier time than before. You will therefore be able to distribute the workload over a longer period of the month instead of taking all checks only after the first productive payroll is run.

Productive payroll - a important fase

The next step in the process is the productive salary settlement. This will naturally be the biggest process. This is also the process where you can automate a great deal of the work .

The process usually includes:

- To start the payroll run

- Perform the payroll run

- Simulate accounting

- Initiate policies (the controls)

- Monitor

- End salary settlement

The reason why much can be automated in this process is that all the programs to be run can be predefined . When you start the process, jobs are started in the background with relevant selection criteria.

All the controls are predefined, and when you get to the point of monitoring, the individual payroll employee, based on how detailed you have chosen to set up the system, will be able to go straight into their list of tasks that the system has produced. It will lead to significantly reduced time spent on obtaining which data may be wrong! All time is instead spent on relevant data.

You no longer need to run a series of reports, transfer the results to Excel and then look for deviations. And best of all; unlike a saved Excel sheet, the system is dynamic ! This means that once a deviation is checked, it is saved as completed. When you run the process again, the same error will not appear, because you have checked it and marked it as ok, or corrected it. This way, you will not check the same deviation twice. When there are no more points to check on the list, you run payroll one last time, and transfer to bank.

There are also simple predefined checks in this part of the process. This could be to list employees with negative payroll , or employees who are paid more or less than a given percentage change from the previous payroll run, for example 10%. All of the standard checks can be adjusted , and you should focus on building in the checks that are relevant to your company.

In addition to listing employees where you should check whether the result is correct, you will normally also set up checks to find any error messages that need to be corrected. Here you also have the opportunity to help the payroll employee who receives the task by including possible solution options for the individual error messages.

And finally: the finishing touches

The last process in our example is post-processing. This mainly concerns bank transfers and postings , as well as checks linked to these processes.

Examples of controls can be:

- To find employees who should be paid, but who have not been included in the bank file

- To find if any employees have not been included in the posting file

You can set up comparisons to receive warnings if there is a mismatch between what is paid out and what is posted. In addition, you will also be able to set up checks that provide tasks and proposed solutions , if there are error messages in one of the aforementioned documents, bank file or posting file.

Expanded control center and exciting changes to come

In addition to the actual registrations, payroll processing, banking and posting, it is mandatory for all companies to report to the authorities through what we know as an A-meldingen or EDAG (only applies in Norway). Many have this as part of the payroll process itself, which is also recommended.

Since you currently have to use a person-specific login, it is not possible to fully automate this process. In the near future you will be able to use safety certificates, and this part of the process can then be included in an efficient way . Then the system, through PCC, will run jobs and checks for you. In the same way, you will also be able to download sick leave notifications, reimbursement files and tax cards from Altinn, and read them in as part of a process in a system. Today's payroll employee i SAP is, in other words, facing a simpler and more structured everyday working life .

Please note

The prerequisite for you to be able to use Payroll Control Center is that you have payroll in either SAP HCM (also often called OnPrem) or in SuccessFactors EC Payroll (Cloud).

More and more companies are now using the solution, and we at Sariba have built up good and relevant experience within the Payroll Control Center. We know how to optimize your system together with you, and we give advice on how you can maximize the usefulness of the control center. The solution comes from SAP with a standard layout containing a set of controls and roles. In any case, we would recommend that you expand, change and adapt both controls and roles so that your company receives their tailor-made timetable.