By Tor Flugsrud & Eva Hageselle

Are you one of those who experience that the process around sick pay reimbursement is both complicated and laborious? Are you struggling to keep track of the regulations? And do you experience that reimbursement of sickness benefits is lost because reimbursement claims are sent too late to NAV? We absolutely agree that the reimbursement process can be both complicated and time consuming, and we have unfortunately witnessed money being lost because deadlines are not met.

The good news? There is an excellent solution that helps you manage the entire reimbursement process! This solution is delivered in SAP payroll , and is available to both those who have SAP payroll onprem, and for those of you who have chosen the cloud solution SAP Employee Central Payroll (ECP).

If you have SAP payroll onprem, ECP, or a completely different payroll system, we would still recommend you read the rest of this article. Our claim is that the reimbursement solution in SAP will simplify and improve reimbursement work for the vast majority of Norwegian companies!

For you who advance sickness benefits - and everyone else

Reimbursement of sickness benefits in SAP will be useful both for those who advance sick pay beyond the employer period, and for those who do not. Easily.

Obvious gains

Since 2019, NAV has demanded that the income statements be submitted electronically via Altinn, which is easily done from SAP . This is just one of several reasons why we recommend you and your company to use the reimbursement solution in SAP .

The most obvious benefits of using the reimbursement solution are:

- You, as an employer, avoid loss of income due to exceeding the 3-month deadline for claims for reimbursement to NAV.

- You save a lot of manual labor in connection with the administration of reimbursement claims.

It may be a somewhat surprising thought that reimbursement of sickness benefits can be an important contribution to the company's value creation , but it can actually be justified to say that it does. First, by avoiding lost revenue in the form of lost reimbursement. Secondly because you can save significant costs related to the labor-intensive process around the preparation of the income statement (dates, amounts, etc.), submission of claims to NAV, as well as follow-up and reconciliation of reimbursement claims.

Furthermore, we will point out additional benefits you can easily reap by using the reimbursement solution SAP :

- The solution helps you to follow the regulations . For example: When does a social security period start? When does a new employer period start? When has the employee reached the maximum date for sick pay or parental benefit?

- You do not have to manually calculate the reimbursement basis. SAP calculates both fixed and variable reimbursement basis. With regard to the variable reimbursement basis, this is calculated as an average of variable payments in previous months. You choose how many months this calculation is to be made over.

- Expected reimbursement is automatically calculated in the payroll settlement as soon as the absence is registered. If desired, you can therefore post the expected refund in the accounts as income already then. Others prefer to wait to enter a refund as income until it is actually received, ie when the K27 list is received.

- Reconciliation between expected and actual refund received. This report provides very good help in following up submitted requirements.

Reimbursement of sickness benefits - simple and flexible

The reimbursement solution in SAP is flexible in several ways ; The solution provides the opportunity to distinguish between the following conditions:

- Sick pay, own illness

- Parental benefits

- Maternity allowance

- Care allowance, sick child or illness for babysitter

- Childcare allowance

- Care allowance close to relatives

- Tuition sick children

The reimbursement solution in SAP gives you, as an employer, the opportunity to practice different schemes / practices for different groups of employees. For example:

- For employees on a fixed monthly salary, advances are made payroll during illness.

- For employees on hourly wages, sick pay is not advanced beyond the employer period.

- Sick pay is limited to 6G - yes or no.

The refund process

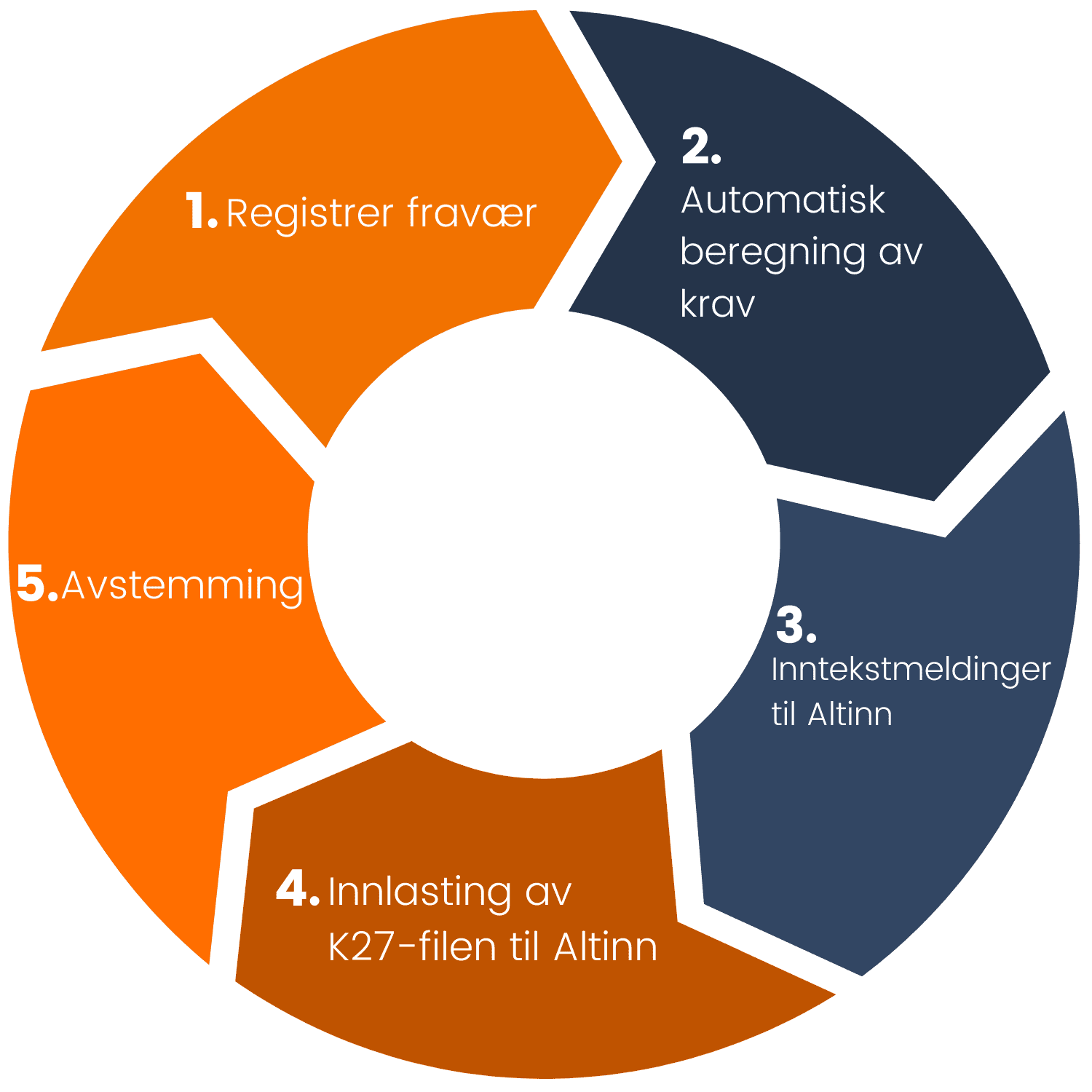

The process of using the reimbursement solution can be described as a rolling wheel. That is, the process is repeated in ever new cycles.

This is how the reimbursement process works

- Absences are recorded either by HR in SAP, or by the employee (he/she records the absence in his/her timesheet)

- Based on the registered absences will SAP , in the next payroll settlement, calculate any expected reimbursement of sickness benefits. These amounts are later used in the reconciliation report.

- On the basis of registered absence calculates SAP employer period and social security period, as well as reimbursement basis.

- Then form SAP an electronic income statement with all the desired information, which is prepared for submission to Altinn.

- The next step is naturally enough to send the income statement up to Altinn. This can be done directly from SAP . You do not need to log in to altinn.no directly to receive the refund claim via the income statement.

- At the beginning of each month, you, as an employer, can log in to altinn.no to download this month's K27 list. This is stored on the disk. Then run a report to load the data into SAP .

- After the next payroll settlement, you can now go to the report for reconciliation of reimbursement. In this, the system compares the calculated refund with the actual received refund, as indicated in the loaded K27 list. With this report, you will easily discover reimbursement claims that have not been met, which will give you a good opportunity to follow this up with NAV.

The reimbursement module in SAP is simple and complex at the same time. Easy for you to use, complex because it keeps track of a comprehensive set of rules, so you do not have to do it.